Top Fintech Companies to Watch in 2025 Leading Innovations and Trends

- Trendinsaas

- No Comments

2025 marks a pivotal moment in the fintech landscape, with top companies like Stripe, Square, Revolut, and Robinhood driving innovations that redefine financial services. These industry leaders are championing advancements such as seamless payment solutions, cryptocurrency integration, and accessible investment platforms. Alongside these trailblazers, emerging trends like AI-powered financial services, blockchain applications beyond cryptocurrencies, digital banking startup and the rise of embedded finance are reshaping how consumers and businesses interact with money. Open banking and APIs foster collaboration, while sustainability-focused fintech solutions promote environmentally conscious decisions. These biggest fintech companies and trends highlight a future where financial services are more inclusive, efficient, and sustainable.

Fintech Industry Overview

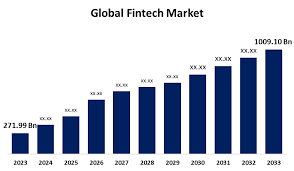

The fintech industry, a dynamic fusion of finance and technology, has revolutionized the way individuals and businesses interact with financial services. Fintech companies have disrupted traditional banking, payments, and investment systems by leveraging innovations such as artificial intelligence, blockchain, and cloud computing. This sector encompasses diverse solutions, from digital banking and peer-to-peer payment platforms to cryptocurrency trading and robo-advisors, making financial services more accessible, efficient, and user-friendly. The industry’s rapid growth is fueled by increasing smartphone penetration, demand for cashless transactions on mobile devices, and a focus on financial inclusion. As fintech continues to evolve, it plays a critical role in shaping a digital-first global economy, catering to both tech-savvy consumers and underserved markets.

Impact on Global Financial Markets

Fintech has revolutionized global financial markets by enhancing accessibility, efficiency, and transparency in financial transactions and services. By disrupting traditional banking systems, fintech companies have introduced innovative digital solutions, that empower both consumers and businesses, offering seamless digital banking, real-time payments, and personalized financial tools. This transformation has made financial services more inclusive, bridging gaps for underserved populations and fostering economic growth. The industry’s rapid expansion is evident, with investments in fintech companies reaching billions of dollars annually, highlighting the trust and confidence of institutional investors in this transformative sector. As fintech continues to reshape the financial landscape, it drives global markets toward a more connected and technologically advanced future.

Digital Banking and Neobanking Trends

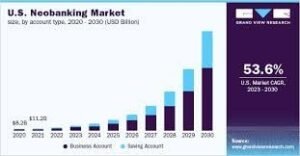

Neobanking, a rapidly growing segment of digital banking, offers digital-only banking services that operate entirely without physical branches. These innovative online banking platforms can provide low-cost, user-friendly, and mobile-first experiences, which have attracted millions of customers globally. Neobanks stand out for their ability to cater to the tech-savvy generation, offering features such as instant account setups, real-time payments, and personalized financial insights. Current neobanking trends include the integration of artificial intelligence, machine learning, and blockchain technology, which enhance customer experience, optimize operations, and strengthen security. As neobanking continues to evolve, it is redefining the future of banking with its convenience, innovation, and accessibility.

Payment Processing and Transaction Trends

Payment processing companies are revolutionizing the way transactions are conducted by leveraging technology to deliver fast, secure, and convenient payment solutions. Emerging trends in this space include the widespread adoption of contactless payments, mobile wallets, and cryptocurrencies, which cater to the growing demand for seamless and flexible payment options. Additionally, companies are focusing on enhancing cross-border payment capabilities, enabling individuals and businesses to conduct international transactions effortlessly and efficiently. By combining innovation with user-centric features, the payment processing industry continues to drive global commerce, offering solutions that cater to the evolving needs of modern consumers and businesses.

Top Leading Fintech Companies

The fintech industry is dominated by leading companies that are reshaping the way financial services are delivered across the globe. Companies like Revolut, Stripe, and PayPal are at the forefront, offering digital banking, seamless payment processing, and innovative solutions for businesses and consumers alike. These trailblazers, alongside N26, Square, and Chime, continue to drive growth, enhancing accessibility, efficiency, and security in financial transactions while paving the way for the future of finance.

Digital Banking and Payments

The digital banking and payments sector is led by innovative companies revolutionizing how financial transactions are conducted. Industry pioneers like Revolut Ltd. and N26 GmbH have redefined personal banking with digital-first platforms that offer global money transfers, real-time spending insights, and multi-currency support. Stripe, Inc. and Block, Inc. (formerly Square) empower businesses with seamless payment processing solutions tailored to e-commerce and point-of-sale needs. Companies like Chime Financial, Inc. and PayPal Holdings, Inc., along with its subsidiary Venmo LLC, focus on user-friendly services that simplify payments and peer-to-peer transactions. Global leaders such as Adyen N.V. and Wise plc (formerly TransferWise) specialize in facilitating cross-border payments with speed and efficiency, while Klarna Bank AB dominates the buy-now-pay-later market, providing flexible payment options for millions of consumers worldwide.

Revolut – Revolut Ltd.

Revolut Ltd. is a global leader in digital banking, offering a wide range of services that include currency exchange, international money transfers, and fee-free spending. With its mobile-first digital banking platform, Revolut has simplified the banking experience, providing users with real-time updates, budgeting tools, and the ability to manage multiple currencies seamlessly. The company continues to innovate, offering crypto trading, stock investments debt financing, and insurance services, positioning itself as a comprehensive financial hub for customers around the world.

N26 – N26 GmbH

N26 GmbH is a German-based mobile bank that has made banking simpler and more accessible with its app-based digital platform itself. Known for its transparent pricing structure, N26 offers users real-time notifications, easy international transfers, and robust financial tools. With an emphasis on a user-friendly interface and low fees, N26 has quickly gained a loyal following, expanding its presence across Europe and the United States, redefining the way people manage their finances digitally.

Stripe – Stripe, Inc.

Stripe, Inc. is one of the most influential payment processing companies in the world, providing businesses with a simple and secure way to accept online payments. Stripe’s platform supports a wide variety of payment methods, including credit cards, digital wallets, and ACH transfers, making it an essential tool for online businesses. It has played a crucial role in enabling small businesses, of all sizes to integrate and manage payments effortlessly, while also offering advanced tools for fraud prevention and financial analytics.

Square – Block, Inc.

Block, Inc. (formerly known as Square), founded by Jack Dorsey, is a prominent player in digital payment solutions, enabling small business owners and businesses to accept payments in-store and online. Through its easy-to-use point-of-sale (POS) systems and mobile apps, Square empowers small and medium-sized businesses with the tools needed to manage payments, inventory, cash flow, and customer relationships. Additionally, Square’s expansion into cryptocurrency services has further solidified its position in the evolving fintech ecosystem.

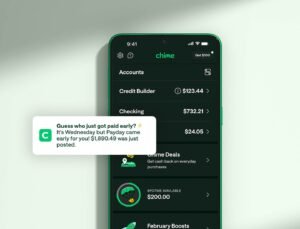

Chime – Chime Financial, Inc.

Chime Financial, Inc. is an American neobank that provides a range of banking services without the need for physical branches. Known for its user-centric approach, Chime offers free checking and savings accounts, fee-free overdraft protection, and access to a large ATM network. With a focus on customer satisfaction and simplicity, Chime is helping users manage their finances with ease, all while bypassing the traditional banking system to reduce costs and improve accessibility.

PayPal – PayPal Holdings, Inc.

PayPal Holdings, Inc. is one of the most recognized names in digital payments, offering a secure and convenient platform for individuals and businesses to send and receive money online. With a broad user base, PayPal facilitates online purchases, peer-to-peer transfers, and international transactions. As part of its expanding services, PayPal has also integrated cryptocurrency trading and expanded its merchant solutions, making it an essential tool for e-commerce and financial services worldwide.

Adyen N.V.

Adyen N.V. is a global payment solutions provider that caters to businesses of all sizes, offering an integrated platform for processing payments across online, mobile, and point-of-sale channels. Its unified platform supports a wide range of payment methods and currencies, making it ideal for global commerce. Adyen is known for its seamless user experience and robust fraud protection, providing businesses with the tools to enhance their payment processes and optimize the customer experience.

Venmo – Venmo LLC (a subsidiary of PayPal)

Venmo LLC, a subsidiary of PayPal, is a popular peer-to-peer payment service that allows users to transfer money easily via their smartphones. Venmo’s social aspect sets it apart, with users able to share and comment on transactions, making it not only a payment platform but also a social experience enables users. While primarily used for personal transactions, Venmo has expanded its features, allowing users to pay for goods and services and withdraw funds to their bank accounts seamlessly.

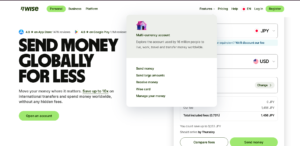

Wise – Wise plc (formerly TransferWise)

Wise plc, parent company formerly known as TransferWise, is a fintech company specializing in low-cost international money transfers. By utilizing a peer-to-peer system, Wise allows individuals and businesses to send money across borders at a fraction of the cost compared to traditional banks. The company’s transparent pricing and real-time exchange rates have earned it a reputation as a reliable and efficient service for those looking to make international payments quickly and affordably.

Klarna – Klarna Bank AB

Klarna Bank AB is a leading Swedish fintech financial services company, providing a buy-now-pay-later service that has gained popularity worldwide. Klarna allows consumers to shop online and to pay bills in installments or delay payments without incurring interest or fees. By partnering with thousands of online retailers, Klarna has revolutionized the shopping experience, offering flexible payment options and helping customers manage their spending in a hassle-free way. Klarna’s focus on customer experience and trust has made it one of the top players in the BNPL market.

Financial Data and Analytics

The financial data and analytics sector is at the forefront of driving informed decision-making in the financial industry. Companies like Plaid Inc., Quovo, Inc., and Yodlee, Inc. (a subsidiary of Envestnet) provide robust platforms for aggregating financial data and delivering actionable insights to banks, fintechs, and developers. Fidelity National Information Services, Inc. (FIS) and Fiserv, Inc. lead in offering enterprise-grade financial services and solutions for payment processing, core banking, and risk management. Morningstar, Inc. and FactSet Research Systems Inc. excel in delivering cutting-edge technology top-edge research, analytics, and data visualization tools for asset management, helping businesses and investors make well-informed financial decisions. These companies continue to shape the future of financial intelligence, empowering organizations to navigate the complexities of a data-driven economy.

Plaid – Plaid Inc.

Plaid Inc. is a fintech company that specializes in providing financial data and analytics solutions to banks, fintechs, and developers. Plaid’s platform allows users to link their bank accounts to various financial apps, enabling seamless data sharing for payments, lending, and investing. With a focus on security and ease of easy to use platform itself, Plaid is transforming the way financial data is accessed and utilized, making it easier for developers to create financial applications that are both powerful and user-friendly.

Quovo – Quovo, Inc.

Quovo, Inc. is a financial data and analytics company that offers real-time data aggregation and analysis to financial institutions. Quovo’s platform helps businesses gather and utilize data from various financial accounts, providing valuable insights for decision-making and improving customer experiences. By offering advanced financial analytics tools, Quovo supports a wide range of financial services, including investment management, lending, and wealth planning.

Yodlee – Yodlee, Inc. (a subsidiary of Envestnet)

Yodlee, Inc., a subsidiary of Envestnet, is a leading financial data aggregation platform, offering comprehensive data and analytics solutions to banks, fintechs, and wealth management firms. With its extensive access to consumer financial data, Yodlee enables businesses to provide personalized financial services, improve decision-making, and enhance customer engagement. Yodlee’s powerful API-driven platform is integral to many fintech applications, delivering insights that help businesses meet the needs of their clients.

FIS – Fidelity National Information Services, Inc.

Fidelity National Information Services, Inc. (FIS) is a global leader in providing technology solutions for the financial services industry. FIS offers a broad range of products, including payment processing, banking solutions, risk management, and wealth management. With its innovative platform, FIS serves financial institutions, retailers, and businesses, helping them streamline operations and enhance the customer experience while navigating the complexities of the full financial technology ecosystem.

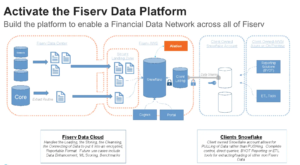

Fiserv – Fiserv, Inc.

Fiserv, Inc. is a global fintech company specializing in financial services technology, offering a wide array of solutions for payment processing, banking, and digital banking. Fiserv’s comprehensive suite of tools helps businesses improve their financial operations, manage risk, and enhance customer experiences. Its emphasis on innovation and operational efficiency has made Fiserv a trusted partner for banks, credit unions, and fintech companies worldwide.

Morningstar – Morningstar, Inc.

Morningstar, Inc. is a leading provider of independent investment research, offering data, analysis, and tools to help individuals and institutions make informed financial decisions. Morningstar’s platforms provide insights into mutual funds, stocks, and other financial products, making it an essential resource for investors and financial advisors seeking to build diversified portfolios. With a commitment to transparency and data integrity, Morningstar continues to shape the investment landscape, providing critical resources for investors and financial professionals alike.

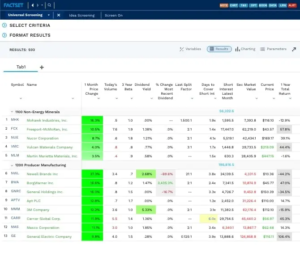

FactSet – FactSet Research Systems Inc.

FactSet Research Systems Inc. is a provider of financial data and analytics, helping businesses and investors access critical insights into global markets. FactSet’s platform offers comprehensive tools for portfolio management, risk analysis, and investment research, allowing clients to make more informed financial decisions. By providing real-time market data, analytics, and software solutions, FactSet continues to empower financial professionals to optimize their strategies and navigate complex market conditions.

Blockchain and Cryptocurrencies

The blockchain and cryptocurrency sector has revolutionized the financial industry by introducing decentralized, secure, and transparent solutions for transactions and investments. Companies like Coinbase, Ripple, and Binance are at the forefront of this innovation, providing platforms for trading, storing, and transferring digital assets. Additionally, firms such as Chainalysis specialize in blockchain analytics and security, helping governments and businesses combat fraud and ensure regulatory compliance. These companies are driving the adoption of blockchain technology and cryptocurrencies in emerging markets, making them integral to the future of finance.

Coinbase – Coinbase Global, Inc.

Coinbase Global, Inc. is a leading cryptocurrency exchange that has simplified the process of buying, selling, and managing digital assets. Renowned for its user-friendly interface, Coinbase allows individuals and businesses to securely trade a variety of cryptocurrencies, including Bitcoin and Ethereum. The platform also offers a secure wallet, staking options, and advanced trading features, making it a comprehensive solution for both new and experienced crypto enthusiasts.

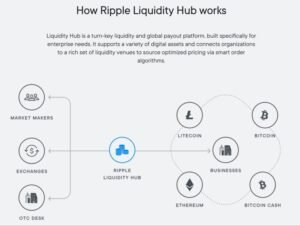

Ripple – Ripple Labs, Inc.

Ripple Labs, Inc. is a blockchain-based financial technology company, known for its revolutionary approach to cross-border payments. By leveraging its native cryptocurrency, XRP, and the RippleNet platform, Ripple enables financial institutions to process global transactions quickly and cost-effectively. Ripple’s proprietary technology, is designed to enhance liquidity and eliminate the inefficiencies of

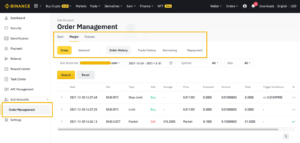

Binance – Binance Holdings Ltd.

Binance Holdings Ltd. is one of the largest and most versatile cryptocurrency exchanges globally, offering trading services for a vast array asset classes of digital assets. In addition to trading, Binance provides users with a comprehensive suite of services, including staking, digital lending platform, and a decentralized exchange platform. With its commitment to innovation and security, Binance has become a central hub for crypto enthusiasts and a leader in the blockchain ecosystem.

Chainalysis – Chainalysis, Inc.

Chainalysis, Inc. is a blockchain analytics company that provides data, software, and services to governments, businesses, and financial institutions. Its tools crowdfunding platforms are designed to enhance transparency and security in cryptocurrency transactions, helping organizations detect and prevent fraud, money laundering, and other illicit activities. Chainalysis plays a vital role in promoting trust and compliance within the rapidly growing blockchain industry.

Lending and Wealth Management

Lending and wealth management platforms have democratized access to financial tools, enabling individuals to borrow, invest, and manage their wealth with ease. Companies like Robinhood and SoFi offer user-friendly platforms for trading, investing, and personal loans, making financial services accessible to a broader audience. Similarly, LendingClub focuses on peer-to-peer lending, while Betterment provides automated investment solutions tailored to individual goals. These platforms are transforming the way people approach lending registered investment advisors and wealth management, offering innovative solutions that prioritize affordability, transparency, and convenience.

Robinhood – Robinhood Markets, Inc.

Robinhood Markets, Inc. is a pioneering fintech company that revolutionized investing by offering commission-free trading on stocks, ETFs, options, and cryptocurrencies. With its mobile-first platform, Robinhood has democratized finance, enabling individuals to invest with ease and minimal costs. The platform also offers features like recurring investments and educational tools, making it an appealing option for new and experienced investors alike.

SoFi – Social Finance, Inc.

Social Finance, Inc. (SoFi) is a leading fintech company offering a wide range of financial services, including personal loans, student loan refinancing, loans online, mortgages, and investment options. Known for its customer-centric approach, SoFi combines traditional lending with modern financial tools to help users achieve their financial goals. Its all-in-one app provides seamless access to banking, investing, and budgeting services, making it a popular choice among young professionals.

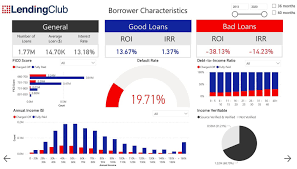

LendingClub – LendingClub Corporation

LendingClub Corporation is a peer-to-peer lending platform that connects borrowers and investors, offering personal loans at competitive rates. By leveraging technology, LendingClub simplifies the borrowing process while providing investors with opportunities to earn returns on their investments. As one of the first fintech companies to disrupt traditional lending and credit history, LendingClub continues to innovate in the field of personal finance and credit access.

Betterment – Betterment Holdings, Inc.

Betterment Holdings, Inc. is a leading digital wealth management platform that offers automated investment solutions tailored to individual goals. Using advanced algorithms and financial planning tools, Betterment provides users with diversified portfolios, tax-efficient strategies, and personalized advice. By eliminating the complexities of traditional wealth management, Betterment has made investing more accessible and affordable for individuals seeking long-term financial growth.

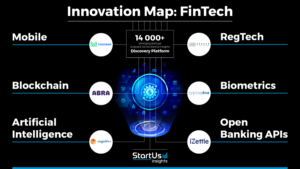

Fintech Startups and Innovation

Fintech startups are transforming the financial landscape by leveraging cutting-edge technology to deliver innovative and efficient financial services. These startups are disrupting traditional banking and finance models, offering solutions that prioritize convenience, speed, and user experience. With the integration of artificial intelligence (AI) and machine learning (ML), fintech startups are enabling smarter decision-making processes, automating workflows, and providing personalized financial recommendations. Blockchain technology is also a significant trend, driving advancements in secure and transparent transactions, digital identity verification, and decentralized finance (DeFi) applications.

Another hallmark of fintech startups is their focus on consumer-centric services, emphasizing personalized and secure solutions for both individuals and businesses. By addressing specific pain points such as high fees, accessibility challenges, and inefficiencies in traditional systems, these startups are creating platforms that cater to diverse financial needs. Whether it’s offering app-based banking, peer-to-peer lending, a financing solution or innovative payment systems, fintech startups are shaping the future of finance. Their ability to adapt quickly and embrace emerging technologies makes them key players in revolutionizing how financial services are delivered globally.