ARR vs MRR: The Essential Guide to Choosing the Right Metric for SaaS

- Trendinsaas

- No Comments

ARR vs MRR: The Essential Guide to Choosing the Right Metric for SaaS

In the world of SaaS (Software as a Service), understanding your company’s recurring revenue stream and metrics is crucial to tracking growth and making informed decisions. ARR (Annual Recurring Revenue) and MRR (Monthly Recurring Revenue) are two of the most important metrics for measuring recurring revenue streams. While they may seem similar, each has unique use cases and benefits, making it essential to know which is best suited for your business goals.

Choosing between ARR and MRR requires a clear understanding of your business model, contract types, and the level of detail you want in your revenue tracking. This guide will help you navigate these metrics and determine the right approach for your SaaS business.

Understanding the Recurring Revenue business model

The recurring or recurring revenue model is the backbone of SaaS businesses, offering financial stability and predictability. By understanding its definition and importance, companies can better harness this revenue type to drive sustainable growth.

Definition of recurring revenue

Recurring revenue refers to the consistent and predictable portion of a company’s revenue stream or total revenue amount, generated through customer payments that renew based on contractual agreements. This ensures a stable income stream, helping businesses maintain financial predictability.

Recurring revenue provides benefits like enhanced client retention, additional revenue generated smoother cash flow, and subscription based businesses a more reliable financial foundation. For SaaS businesses, this is particularly valuable as it forms the core of their subscription-based models.

Importance of recurring revenue for SaaS businesses

For SaaS companies, tracking recurring revenue serves as a reliable measure of a business’s financial health. It enables businesses to pinpoint areas for improvement and optimize their operations for long-term growth.

Additionally, recurring revenue allows companies to forecast cash flow accurately and make strategic decisions based on predictable income patterns. This stability is crucial for scaling operations and managing resources effectively. It also creates a strong foundation for customer lifetime value (CLV) calculations and helps businesses identify trends in customer behavior.

MRR and ARR: Key Metrics for SaaS

MRR and ARR are the most critical metrics for SaaS businesses to measure recurring revenue. Understanding their definitions, calculations, and applications is vital for tracking business performance forecast future revenue too.

Definition of monthly recurring revenue (MRR)

Monthly Recurring Revenue (MRR) measures the average revenue generated each month from paying customers. It is an essential metric for businesses with monthly subscription models.

MRR is a valuable indicator of a company’s financial and business health too, as it tracks month-to-month revenue trends. By monitoring MRR, SaaS companies can gain insights into customer retention, subscription upgrades, and overall business performance. MRR also acts as a short-term performance indicator, highlighting areas where immediate actions might be needed.

Definition of annual recurring revenue (ARR)

Annual Recurring Revenue (ARR) measures the total recurring revenue generated by subscription business in a year. This metric provides a long-term view of revenue growth for subscription business and is particularly relevant for businesses with annual contracts.

ARR helps predict and calculate annual recurring revenue and revenue accrual, offering a broader perspective on financial performance. It is especially useful for businesses seeking to understand long-term profitability and strategic planning. ARR is often used in investor presentations, as it demonstrates the company’s ability to generate stable and predictable revenue over time.

Calculating MRR and ARR

Calculating MRR and ARR accurately is crucial to ensure these metrics reflect the true financial health of your SaaS business. Proper calculations help track revenue growth and identify areas for improvement.

How to calculate MRR

To calculate MRR, use the formula: MRR = ARPU (Average Revenue Per Unit) × Number of Subscribers. For accurate calculations, exclude non-recurring revenue and focus on subscription revenue – payments received within one month. This ensures that your MRR reflects consistent and predictable income.

For example, if you have 200 subscribers paying an average of $50 per month, your MRR would be:

MRR = 200 × $50 = $10,000

How to calculate ARR

ARR is calculated as: ARR = 12 × MRR. This formula multiplies monthly recurring revenue by 12, providing an annualized view of total revenue generated. Like MRR, ARR excludes non-recurring revenue to maintain accuracy and reliability. For instance, if your MRR is $10,000, then your ARR would be:

ARR = $10,000 × 12 = $120,000

ARR also accounts for annual contracts more directly, which can simplify financial forecasting for businesses that operate on long-term agreements.

Choosing Between MRR and ARR

ARR equals 12 times MRR only if the customer base remains constant. However, customer revenue changes with subscriptions and MRR can fluctuate due to customer acquisition, renewals, or upgrades, which may result in variations in ARR.

Understanding these dynamics is critical for accurate financial forecasting and managing growth strategies effectively. It’s also important to note that ARR may incorporate discounts or promotions that influence annual contract values, creating slight discrepancies.

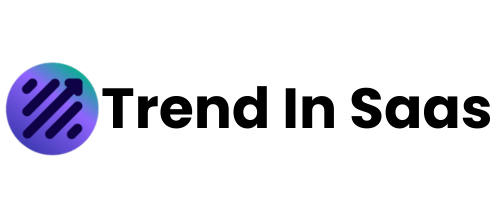

Factors to consider when choosing between MRR and ARR

The choice between MRR and ARR depends on several factors, including the type of SaaS business you operate. Businesses with annual subscription contracts may benefit more from ARR, while those with monthly subscriptions often rely on MRR for frequent updates.

Consider how often you want to track future revenue, and align your choice with your business goals. If your priority is long-term financial planning, ARR is likely more suitable. Conversely, MRR provides real-time insights, enabling agile responses to market changes.

Is ARR 12 times MRR?

ARR is generally 12 times MRR when the customer base remains constant, and there are no significant changes in subscription values or customer churn. However, factors like new customer acquisitions, subscription upgrades, downgrades, and customer cancellations can cause fluctuations in MRR, making ARR more or less than 12 times the current MRR. Businesses should continuously monitor these metrics to ensure accurate projections and align them with their financial goals.

For example, if your MRR is $8,500 due to new customer acquisitions, your ARR would be calculated annually as $8,500 × 12 = $102,000. This assumes a steady customer base and consistent subscription rates. Any deviation from these factors could alter the outcome forecast revenue amount, requiring periodic reassessments.

Understanding your SaaS financials

Download the SaaS Company Operating & Valuation Model Template to better understand and manage your SaaS financials.

Common Mistakes When Calculating MRR

Accurate MRR calculations are essential for reliable revenue tracking. Avoiding common errors ensures that your metrics provide a true reflection of business performance.

Including quarterly, semi-annual, or annual contracts at full value in a single month

When calculating MRR, divide the total subscription value calculated as monthly revenue, by the intended subscription length. This ensures accurate representation of monthly revenue without overestimating.

For example, a $1,200 annual contract should contribute $100 per month to MRR rather than monthly fluctuations rather than being included as a single lump sum. Such adjustments make the metric more reflective of your recurring revenue streams.

Subtracting transaction fees and delinquent charges

Avoid subtracting transaction fees calculate monthly recurring revenue or including one-time payments in your MRR calculations. MRR focuses solely on recurring revenue, and any deviation from this can distort your financial metrics. Non-recurring revenue, such as onboarding fees, should be tracked separately. Consistently separating these figures ensures clarity and prevents overestimation of your MRR.

Including one-time payments and trials

Perhaps the most egregious mistake is including trials and their expected subscription value before they actually convert into recurring subscriptions from paying customers. Trials are not guaranteed revenue, and including them in MRR calculations can lead to overestimations. Ensure that only actual, recurring payments from paying customers are considered to maintain the reliability of your metrics

Using MRR to Grow Your SaaS Business

MRR isn’t just a tracking metric; it’s a growth enabler for SaaS companies. Leveraging it strategically can help businesses scale effectively and meet their revenue goals.

Product-market fit compass metric

MRR serves as a key metric for tracking growth in SaaS organizations. After establishing product-market fit, use MRR to monitor customer retention, subscription upgrades, and overall business success. Regularly analyzing MRR trends helps businesses identify opportunities for scaling and addressing market demands effectively.

Sales team strategies for increasing MRR

Your sales team can boost MRR by focusing on high-quality leads and securing long-term subscriptions. Emphasizing value and building strong customer relationships also play a significant role in increasing revenue. Upselling and cross-selling strategies can further enhance MRR, as they encourage existing customers to to explore premium offerings. By aligning sales efforts with customer needs, businesses can create a sustainable path for growth.

A critical financial metric for SaaS growth

MRR is a crucial financial metric—it is key indicator that gives you the most accurate status check-up of your SaaS or company’s financial performance.

Customer Acquisition Cost and MRR

Balancing Customer Acquisition Cost (CAC) with MRR is crucial for sustainable growth. Reducing CAC while improving MRR ensures long-term profitability for SaaS businesses.

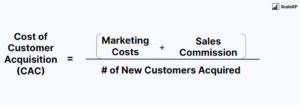

How customer acquisition cost affects MRR

Customer Acquisition Cost (CAC) measures the expense of acquiring new customers and directly impacts lost revenue and lost MRR. High CAC can strain resources, reducing profitability despite revenue growth. Monitoring the ratio of CAC to MRR helps businesses evaluate the effectiveness of their acquisition strategies.

Strategies for reducing customer acquisition cost

Focus on customer retention and renewal rates to reduce CAC. Optimizing sales and marketing strategies to attract high-quality leads can also improve efficiency and profitability. Building a strong referral network and leveraging content marketing are effective methods for net revenue retention lowering CAC without compromising MRR growth. These strategies ensure a balanced approach to increasing revenue while managing acquisition costs.

Other Key Metrics to Use with MRR

MRR is a powerful metric, but pairing it with other key performance indicators provides a holistic view of business performance. Metrics like CLV and ARPU add depth to revenue tracking.

Customer lifetime value (CLV)

Customer Lifetime Value (CLV) calculates the total value of a customer over their lifetime. This metric complements MRR by providing insights into long-term profitability. By understanding CLV, businesses can make data-driven decisions about customer acquisition and retention investments, ensuring maximum returns

Average revenue per user (ARPU)

ARPU measures the average revenue generated per customer, offering a clear view of a company’s revenue and potential. This metric is particularly useful for evaluating pricing strategies and customer segmentation. By analyzing ARPU alongside MRR, businesses can identify opportunities for increasing customer spend and optimizing retention strategies. Together, these metrics provide a comprehensive understanding of customer behavior and revenue growth.

Limitations of MRR

While MRR is a valuable metric, it has its limitations. Knowing when to use ARR instead can help SaaS companies make informed financial decisions.

What MRR doesn’t measure

MRR only accounts for recurring revenue, excluding one-time payments, trials, and other non-recurring income. This limitation makes it less suitable for businesses with diverse revenue streams. For comprehensive financial analysis, combining MRR with other metrics ensures a well-rounded perspective.

When to use ARR instead of MRR

ARR is ideal for businesses with annual contracts or those seeking a long-term revenue perspective. Use ARR when you need to plan for strategic growth over extended periods. ARR can also be useful for communicating long-term stability to investors or stakeholders. By focusing on ARR, businesses can align their operations with larger financial goals and achieve sustainable growth.

Best Practices for Increasing MRR

Growing MRR is essential for scaling SaaS businesses. Implementing best practices ensures consistent growth and a stronger financial foundation.

Reinforce your value

Reducing the churn rate is critical for MRR growth. Focus on customer retention and renewal strategies to maintain consistent revenue and minimize losses. Providing excellent customer support, regular product updates, and personalized engagement can strengthen customer loyalty and improve retention rates.

Get your pricing strategy right

Experiment with different pricing models to find the optimal balance between affordability and profitability. Flexible pricing plans can also encourage customers to scale their usage. Additionally, offering tiered plans with clear value propositions

Make it easy for customers to scale their usage and spend

Simplify the process for customers to upgrade their plans or access additional features. By reducing barriers, such as lengthy procedures or hidden costs, businesses can improve the customer experience and drive revenue growth. Transparent communication about the benefits of scaling ensures that customers see the value in upgrading.

Offering a variety of pricing plans tailored to different customer segments can increase MRR and ARR. Flexible options, such as tiered pricing or pay-as-you-go models, enable customers to choose plans that align with their budgets and requirements. This approach not only attracts a diverse customer base but also encourages long-term loyalty as businesses evolve alongside their customers.

Conclusion

MRR and ARR are essential metrics for SaaS businesses, providing valuable insights into recurring revenue streams. MRR is ideal for short-term tracking and tactical decision-making, while ARR offers a broader perspective for long-term strategic planning. Understanding the differences between MRR and ARR empowers businesses to align their